Steel and aluminum tariffs aren’t just a headline issue. They have a direct impact on small fabricators’ cost structures, bidding strategies, and overall competitiveness. Below is a high-level breakdown of tariffs that have been either proposed, rolled back, or reintroduced, along with insights into why they matter and how to prepare and stay resilient.

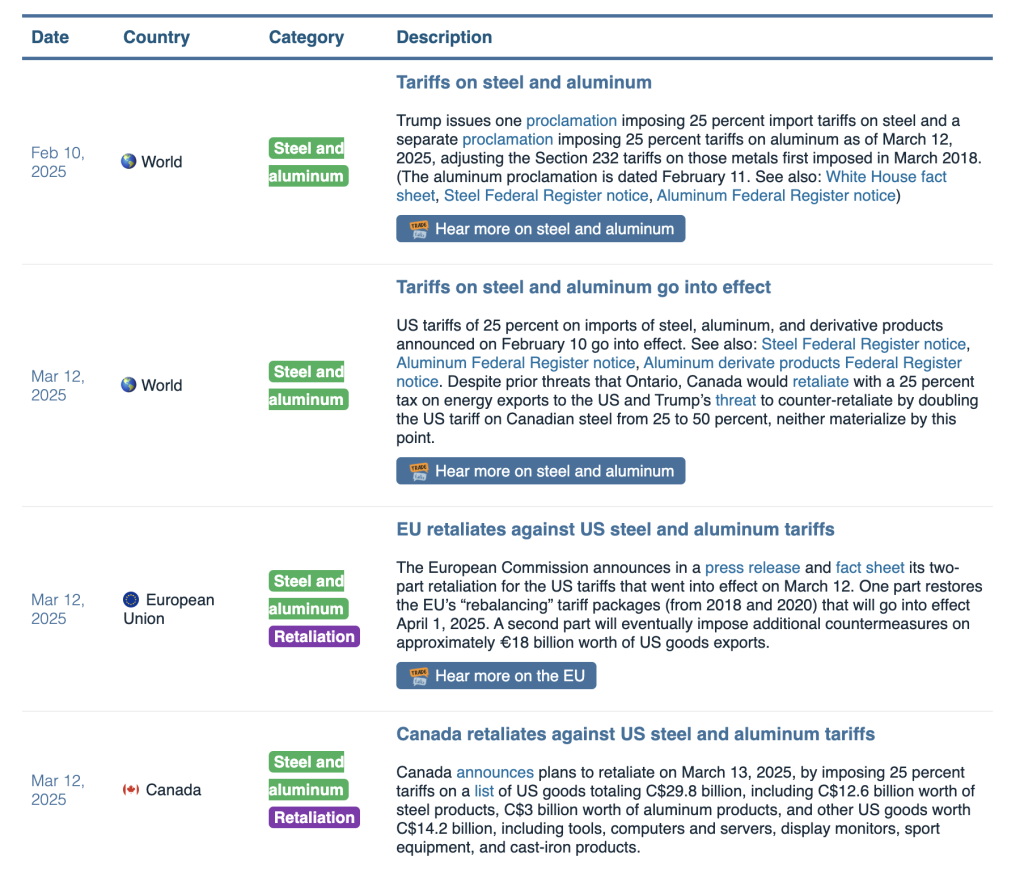

Steel and aluminum tariffs: Current and proposed

Tariffs at 25% and elimination of exemptions

Over the past several years, the U.S. has shifted steel and aluminum tariffs multiple times under Section 232 of the Trade Expansion Act.

Initially set at 25% for steel and 10% for aluminum in 2018, these duties were expanded in 2020 to include certain derivative products.

On February 10, 2025, the U.S. Government ended country-specific exemptions and exclusions, raising aluminum tariffs to 25% and retaining the 25% steel tariff, now applied more broadly.

As of March 12, 2025, nearly all steel and aluminum imports face a 25% rate (with Russian aluminum subject to 200%), and any previously granted product exclusions or quotas are revoked.

Elimination of exemptions and quotas

When the U.S. first imposed Section 232 tariffs on steel and aluminum in 2018, several countries negotiated special terms—such as tariff‑rate quotas (TRQs), country‑based exemptions, or product‑specific exclusions.

All such carve‑outs have now been terminated. Specifically:

- End of country‑specific deals: Agreements that allowed countries like Brazil, South Korea, or Argentina to export certain volumes at reduced or zero tariff rates are no longer in effect.

- No more product exclusions: The Commerce Department has been directed to cease all existing product exclusions as of February 10, 2025. Exceptions previously granted remain valid only until they either expire or hit their allowed volume, whichever comes first.

- Termination of GAEs (General Approved Exclusions): GAEs—automatically granted exclusions that faced no objections—officially ended March 12, 2025. From that date forward, steel and aluminum articles once exempt are now subject to the same standard 25% tariff.

Items that were previously duty‑free under various exemptions can suddenly be hit with a 25% tariff (or more, if Russian aluminum is involved). This overhaul significantly raises the cost of importing both raw and derivative steel/aluminum products, and highlights why small metal fabricators should keep close tabs on any new or upcoming changes to tariff policy.

Expansion to derivative products

Beyond raw metal, the U.S. government has increasingly added “downstream” or “derivative” products—such as stamped parts, fasteners, tubing, wire, or other items with high steel/aluminum content—to the existing Section 232 tariffs.

Domestic producers can request that additional goods be included if they believe imports undermine national security or threaten their market. Once the Department of Commerce receives a request, it typically reviews the product scope within about 60 days.

Small manufacturers who rely on imported subassemblies or partially finished components may therefore see jumps in cost, as seemingly routine items (for example, a specialized bracket or machined tube) become subject to a 25% tariff with little notice.

Retaliatory tariffs and international disputes

When the U.S. raises tariffs on imports, other nations often respond with their own duties on American-made goods. Although that typically hits larger industries (e.g., agricultural exports, consumer goods), it can spill over into intermediate goods in advanced manufacturing. If you have global clients or do sub-assembly for exporters, your business might be pulled into the crossfire.

Capacity constraints

Although these new steel and aluminum tariffs are intended to encourage domestic sourcing, U.S. producers—especially aluminum mills—cannot instantly ramp up output to meet demand.

This capacity gap can lead to supply bottlenecks, longer lead times, and higher prices than anticipated, even for shops that prefer buying American-made metals.

How can steel and aluminum tariffs affect small metal fabricators?

Material price inflation

Even if you source predominantly domestic steel or aluminum, U.S. mills often raise their prices when foreign competitors’ costs go up—because the “floor” of the market shifts. This quickly compresses the margins of small shops that can’t easily offset a 10‑20% spike in material costs.

Volatile supplier relationships

- Formerly reliable foreign suppliers may now face large, unpredictable tariff costs—resulting in last-minute price changes or late shipments.

- Domestic suppliers may be slow to scale capacity or still require long lead times for specialized alloys not widely produced in the U.S.

Increased costs for equipment and tooling

Machine tools, replacement parts, and specialty tooling often come from abroad. If those face new tariffs, it could drive up your capital expenses and maintenance costs.

Wider economic uncertainty

Frequent changes in tariff policy can delay capital investments, freeze major construction projects, or make big Original Equipment Manufacturers (OEMs) cautious about awarding new contracts. Many small shops rely on these large players’ stable orders.

Competition pressures and customer pushback

If you need to raise your quotes to cover higher input costs, some customers may look for lower-cost alternatives (potentially in other states or countries that can somehow sidestep tariffs).

Alternatively, if you hold your prices steady, your margins shrink, which can strain cash flow.

How can small metal fabricators prepare and stay resilient

1. Stay informed (and nimble)

- Monitor trade announcements, especially official publications, which detail which products face new or higher rates.

- Regularly check with suppliers to see if their pricing or lead times are about to change.

2. Diversify supplier base

- Don’t rely on a single region. Identify domestic mills or alternative foreign suppliers that remain more cost-competitive, or that haven’t been targeted by specific tariffs yet.

- Lock in supply contracts or buffer stock on key materials that face steep tariff risk.

3. Run multiple ‘what‑if’ scenarios

- Use financial forecasting to model the impact if steel prices go up by 10%, 20%, or more.

- Evaluate how each scenario would affect your final product pricing, profit margins, and timelines.

4. Map out contingency plans for production schedules

- If a tariff unexpectedly jumps from 25% to 50%, you may need to pivot to an alternative supplier or re-sequence jobs. A dynamic production planning and scheduling system can quickly shift resources or resequence jobs with minimal downtime preventing chaos on the shop floor.

5. Analyze costs beyond metals

- Pay attention to any cross-border supply chain elements such as precision components, specialized tooling, or CNC replacement parts. If those are tariffed, factor that into your quoting process.

- Lean or continuous improvement initiatives can help offset some of these new costs by reducing scrap, optimizing run times, or minimizing waste.

6. Track your BOM and mitigate margin erosion

Another critical step is to maintain precise visibility of your bill of materials (BOM) for each project. When steel or aluminum input costs jump, you need to see exactly how that price shock impacts your overall profit margins.

This is especially true if you’re locked into a fixed-price or long-term contract—you can’t easily pass on extra costs without risking the relationship or violating pricing terms.

In practice, a clear BOM helps you know the share of total project costs that raw materials represent. For instance, imagine a $100,000 project in which 35% of costs ($35,000) are tied to steel or aluminum. If tariffs suddenly drive a 25% increase in material prices, that’s an extra $8,750 in direct expenses, raising your final project cost by 13.75%. If you originally counted on a 10% margin, you’re now looking at a 3.75% loss unless you renegotiate the pricing or find a more affordable material source.

A robust MRP system or project-based BOM tracking tool can highlight these risks early, enabling you to:

- Re-price bids or communicate cost changes as soon as possible.

- Identify where you might substitute materials or re-source components with lower tariffs.

- Build a proactive strategy to buffer against sudden cost inflation (for example, by locking in material before the next tariff hike).

Although not every software solution offers detailed cost breakouts for future tariff scenarios, even basic BOM clarity is essential. It shows you where your greatest exposure lies so you can address it—before margins evaporate.

7. Proactive communication with clients

- Customers often prefer transparency. If your metal prices jump 15% because of a new tariff, explain the situation in straightforward terms and how you’re mitigating the impact.

- Establish whether you need to adjust quoting methods (such as, adding a tariff surcharge line item) or sign short-term flexible agreements rather than locking in year-long rates.

8. Keep an eye on retaliatory measures

- If your biggest customers are exporters of finished goods, their markets could be hit by foreign retaliatory tariffs. This might reduce their demand for parts, trickling down to your shop’s order book.

- Building a broad and diversified client base reduces your exposure to a single trade route or product segment.

Steel and aluminum tariffs in summary

Steel and aluminum tariffs policy is a moving target. The goal for a small metal fabrication business is to remain agile and well-informed. With clear insight into your own operations and a solid handle on supply chain variables, you’ll be better positioned to handle sudden tariff hikes (or rollbacks).

- Short-term strategy: Secure multiple suppliers, keep enough buffer material, and adjust quotes quickly.

- Long-term strategy: Invest in automation, lean processes, and robust production planning software that can flexibly adapt to shifts in policy or pricing.

Although the new steel and aluminum tariffs can create headaches for small shops, a forward-looking strategy can turn them into an opportunity. By staying nimble and cost-conscious, and using digital tools to track and forecast changes, you can differentiate yourself even in a volatile market.